income tax rates 2022 south africa

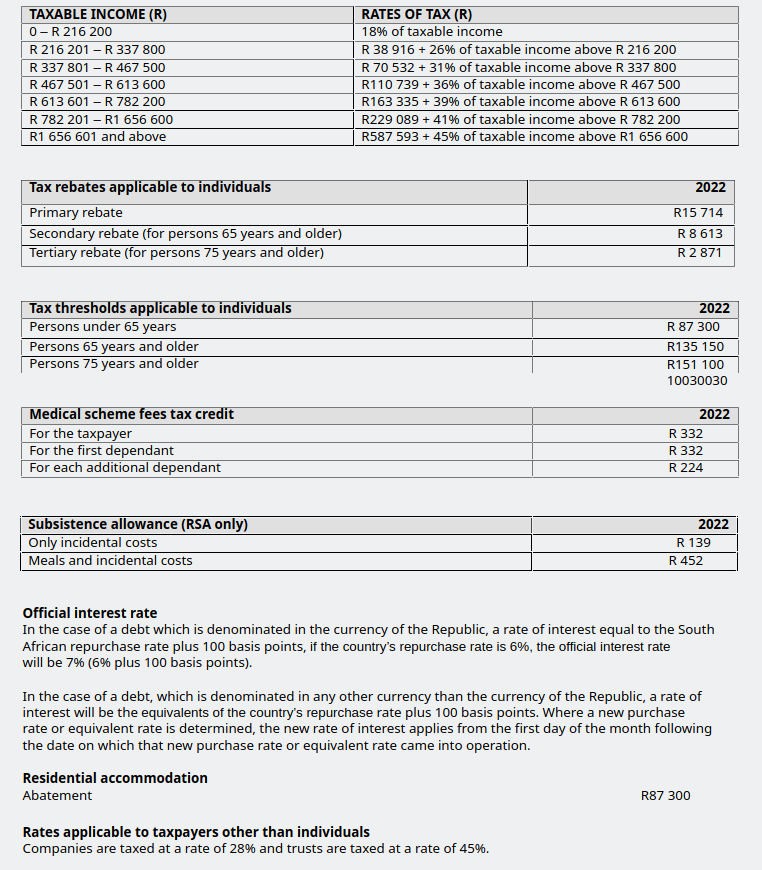

Reduction in corporate income tax rate and broadening the tax base. For the 2022 year of assessment 1 March 2021 28 February 2022 R87 300 if you are younger than 65.

Tax Tables For Individuals And Trusts 2022 Tax

Many of the leading GDP-per-capita nominal jurisdictions are tax havens whose economic data is artificially inflated by tax-driven corporate accounting entries.

. Personal Income Tax Rate in South Africa is expected to reach 4500 percent by the end of 2022 according to Trading Economics global macro models and analysts expectations. Data from the National Treasurys medium-term budget shows that 25 million South Africans are estimated to cover 84 of all personal income tax over the 202223. The budget proposes the adjust personal income tax brackets.

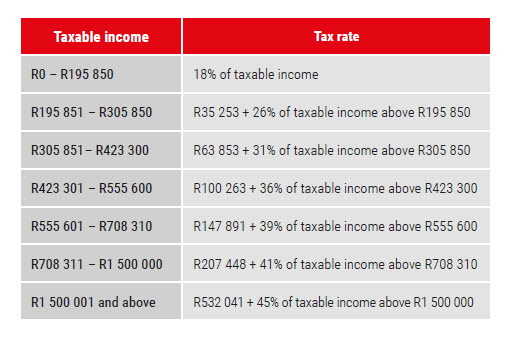

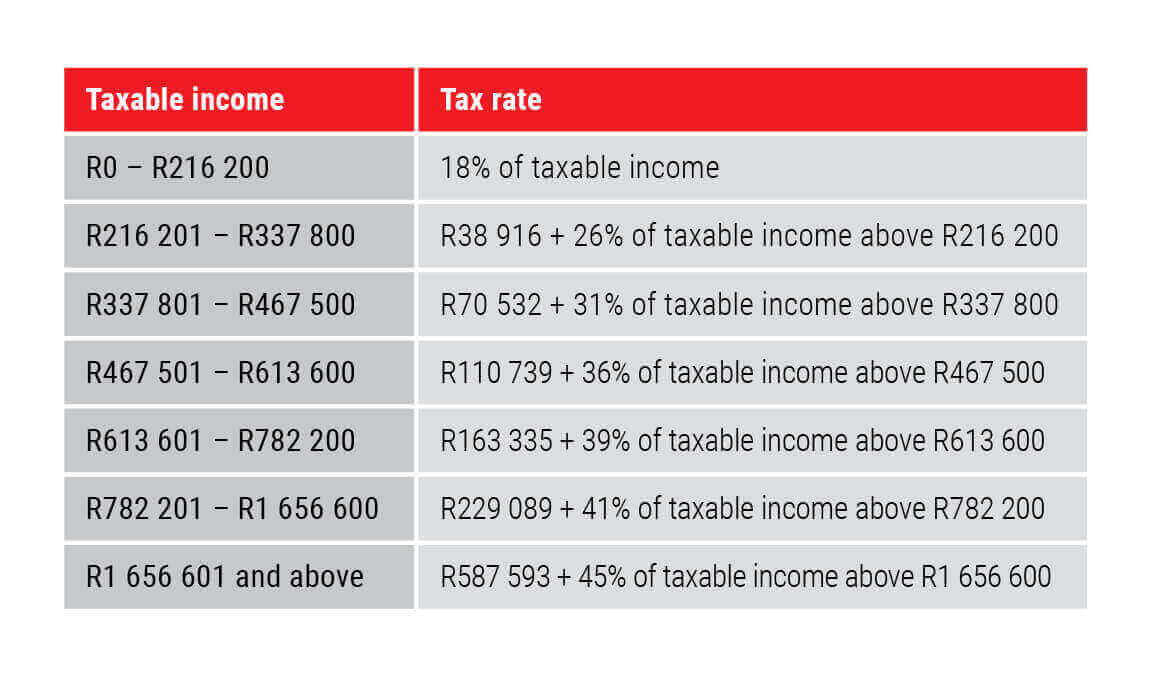

Capital Gains Tax CGT See here how the changes in tax rates affect the age groups per income level from last year to this year. On 23 February 2022 South Africas Minister of Finance Mr Enoch Godongwana presented the 2022 Budget. 1216200 18 of taxable income 216201337800 38916 26 of.

Data from the National Treasurys medium-term budget shows that 25 million South Africans are estimated to cover. Taxable Income R Rate of Tax R 1 91 250 0 of taxable income. The 2022 budget speech delivered 23 February 2022.

The rates for the tax year. 91 251 365 000 7 of taxable. Red flags for South Africas overburdened tax base.

2022 Salary Income Tax Calculator Sage South Africa Our updated and free online salary tax calculator incorporates. 18 of taxable income. 39000 plus 37 cents for each 1 over 120000.

Foreign resident tax rates 202223. 325 cents for each 1. Non-residents are taxed on their South African sourced income.

In this section you will find the tax rates for the past. Years of assessment ending on any date between 1 April 2022 and 30 March 2023. Rates for 202 2 tax year 1 March 202128 February 2022 Individual income tax rate Taxable income ZAR Rate.

From 1 March 2015 2016 tax year a final withholding tax at a rate of 15 will be charged on. For instance the Irish GDP. 40680 26 of taxable income above 226000.

7 rows South Africa Residents Income Tax Tables in 2022. Income Tax Rates and Thresholds. Withholding Tax on Interest.

Tax rates are proposed by the Minister of Finance in the annual Budget Speech and fixed or passed by Parliament each year. You are viewing the income tax rates. Information is recorded from current tax.

Tax on this income. 23 February 2022 No changes from last year. View what your tax saving or liability will be in the 20222023 tax year.

2022 Tax Rates Thresholds and Allowance for Individuals Companies Trusts and Small Business Corporations SBC in South Africa. Choose a specific income tax year to see the South Africa income tax rates and personal allowances used in the associated income tax calculator for the same tax year. For taxpayers aged 75 years and older this threshold is R157 900.

8 rows The tax rate for the year 2022 in South Africa for companies is 27 until March 2023. The same rates of tax are applicable to both residents and non-residents. Quick Tax Guide South Africa 2122 Individuals Tax Rates and Rebates Individuals Estates Special Trusts 1 Year ending 28 February 2022 Taxable income Rate.

73726 31 of taxable income above 353100.

Allan Gray 2018 Budget Speech Update

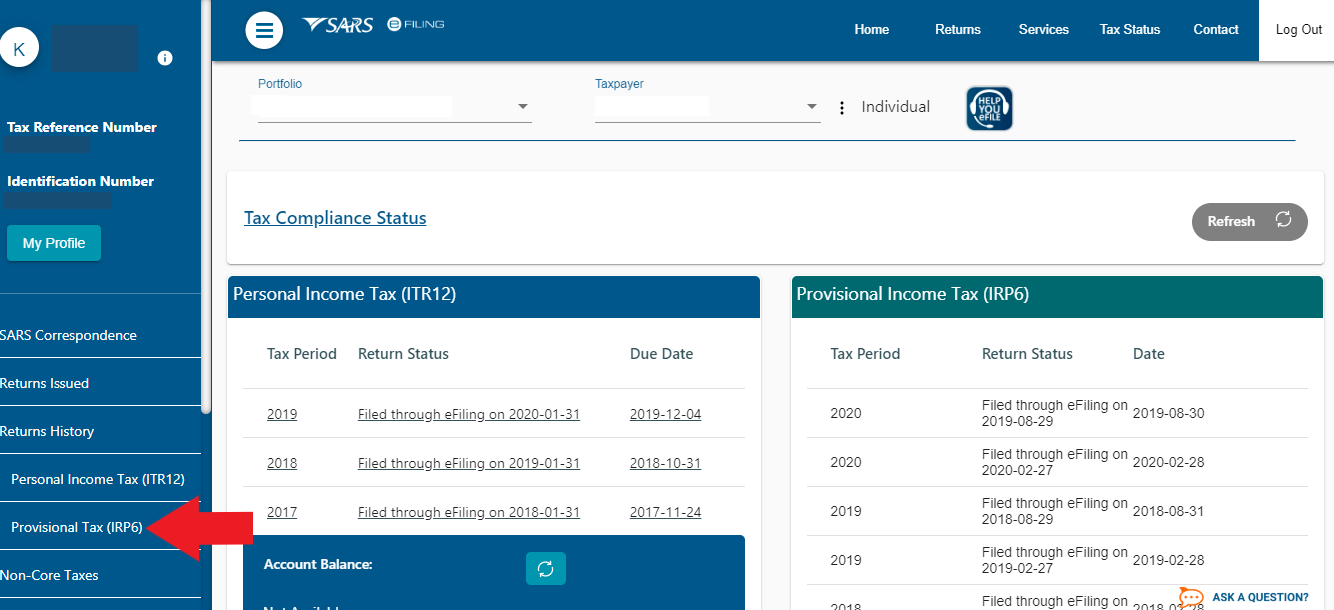

What Is Provisional Tax How And When Do I Pay It Taxtim Sa

Allan Gray 2021 Budget Speech Update

South Africa Budget 2021 Highlights Activpayroll

Free Sars Income Tax Calculator 2023 Taxtim Sa

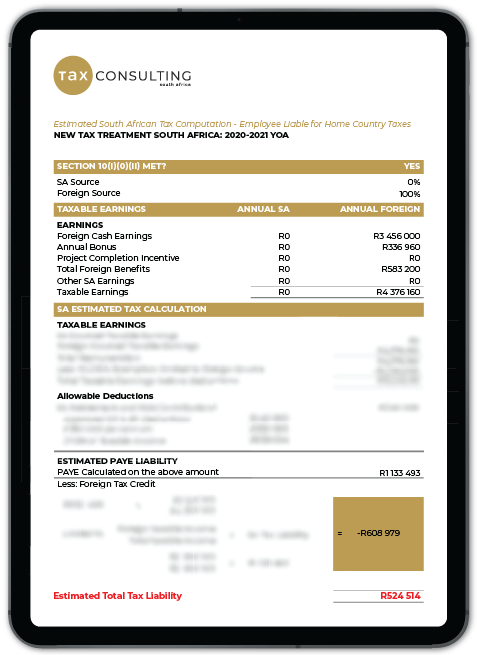

Tax Guide 2021 2022 Tax Consulting South Africa

How Do Income Tax Brackets Work Jou Geld Solidariteit Wereld

Here S How Much Tax You Will Pay This Year Based On Your Earnings In South Africa

Crypto Assets Tax South African Revenue Service

Nfb Private Wealth Management On Twitter The Corporate Income Tax Rate Will Be Lowered To 27 Per Cent For Companies With Years Of Assessment Commencing On Or After 1 April 2022

State Corporate Income Tax Rates And Brackets Tax Foundation

Us New York Implements New Tax Rates Kpmg Global

Alberta S Tax Advantage Alberta Ca

Jalico Accounting Services Budget Speech Summary Corporate Income Tax Rate Will Reduce To 27 From 2023 Tax Year Facebook

Corporate Tax Rates Around The World Tax Foundation